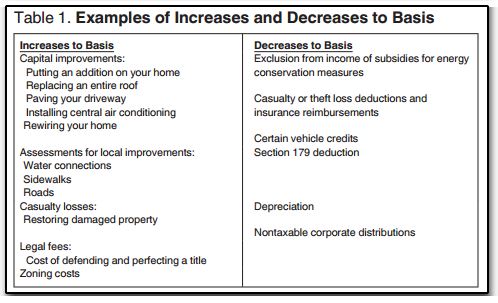

Complex irs regulations give owners of apartment buildings and other commercial structures two options when they dispose of a building s structural components such as a roof hvac unit or windows.

Roof depreciation life.

For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property.

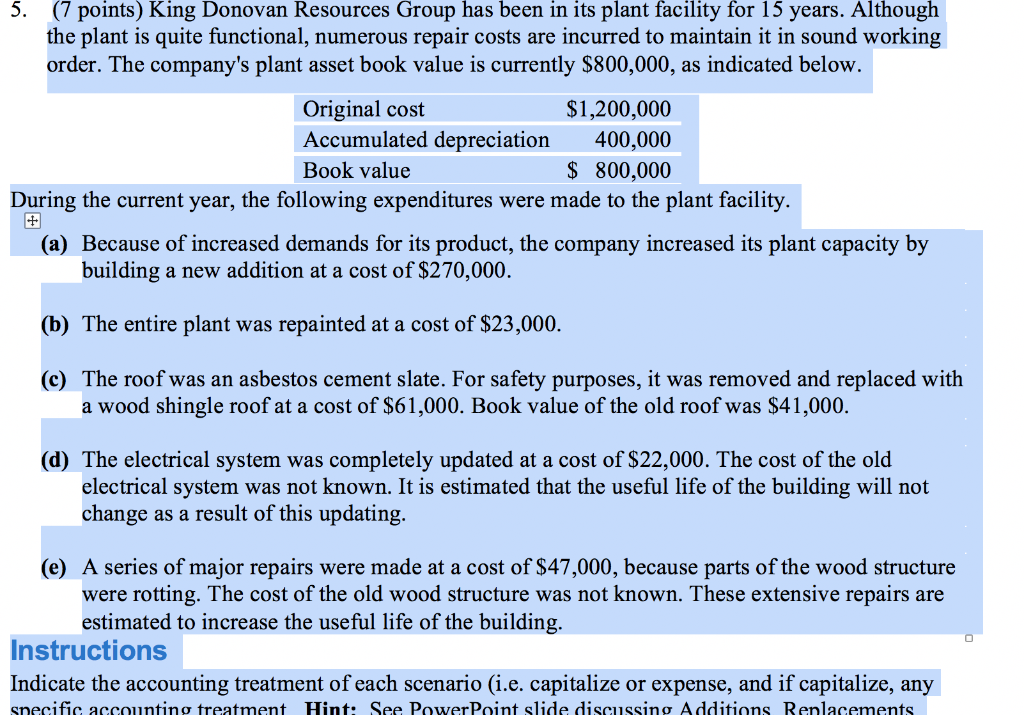

Repainting the exterior of your residential rental property.

How to depreciate a new roof on rental property.

Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance.

For example if the new roof costs 15 000 divide that figure by 27 5.

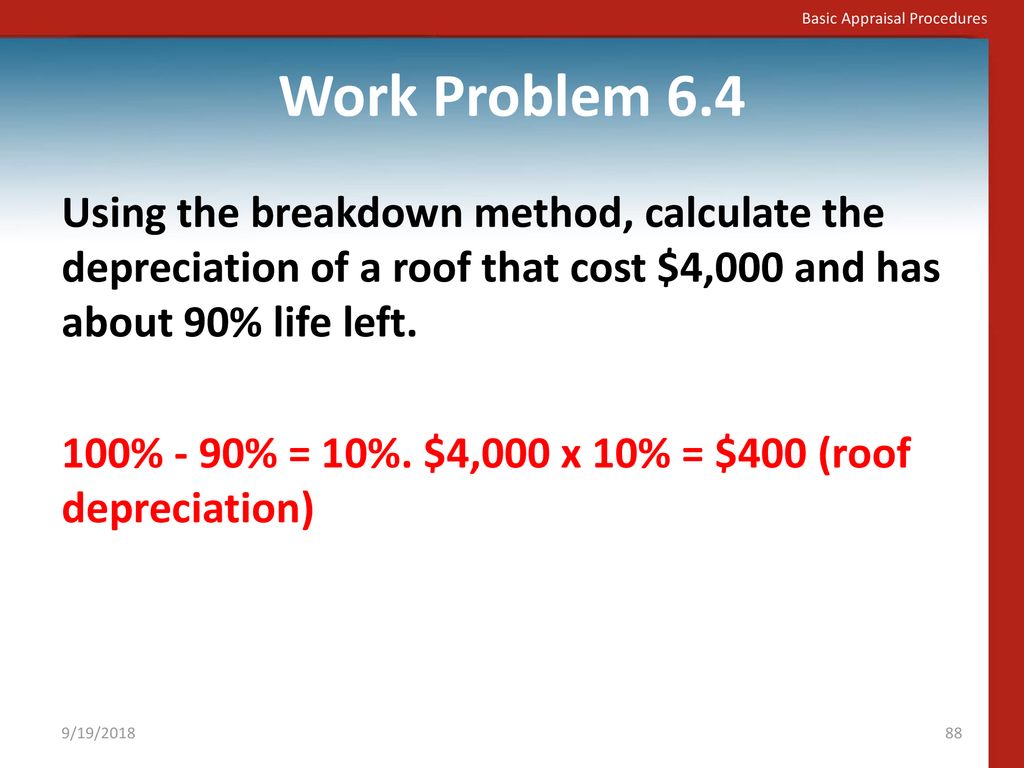

The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.

For example going from asphalt shingles 20 year life to clay tile 50 year life is a betterment that requires capitalization.

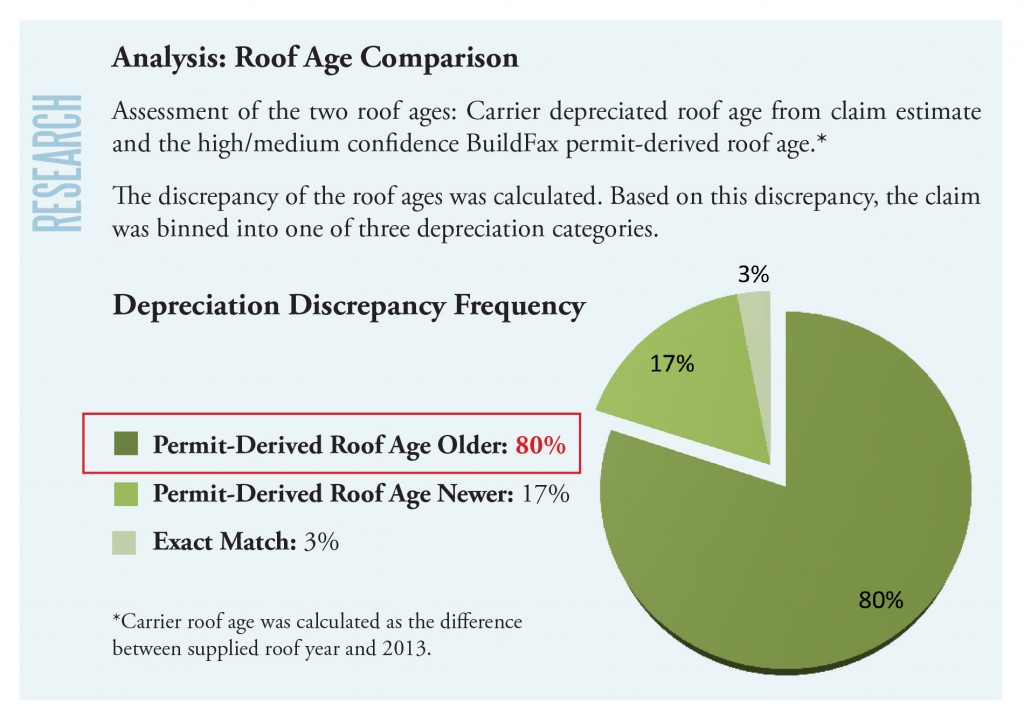

When a claims adjuster looks at a roof he will consider the condition of the roof as well as its age.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged.

They can either continue to depreciate the cost of the replaced component or they can fully deduct the unrecovered cost of the component in the year it is replaced.

Each year tax professionals who deal with real estate must evaluate the most recent building expenditures and determine which items should be written off as a repair expense or capitalized.

10 of the total days it is rented to others at a fair rental price.

In many cases only a portion of the roofing system is replaced and depending on the facts those costs may be deducted as repairs.

Figure out the beginning and end dates.

If improved materials were used taxpayers would need to focus on the expected life of the old roof versus the expected life of the new roof.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

This means the roof depreciates 545 46 every year.

The roof depreciates in value 5 for every year or 25 in this case.

A capital improvement is any major replacement or renovation that betters the rental property or.

Decide if the new roof is a capital improvement.

Are generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

Calculating depreciation based on age is straightforward.